Whitbread trading statement

Good total sales growth of 8.6% for the third quarter

On track to deliver full year results in line with expectations

Whitbread PLC today reports its trading performance to 1 December 2016.

Sales update (% change vs. prior year)

Alison Brittain, Chief Executive of Whitbread, comments:

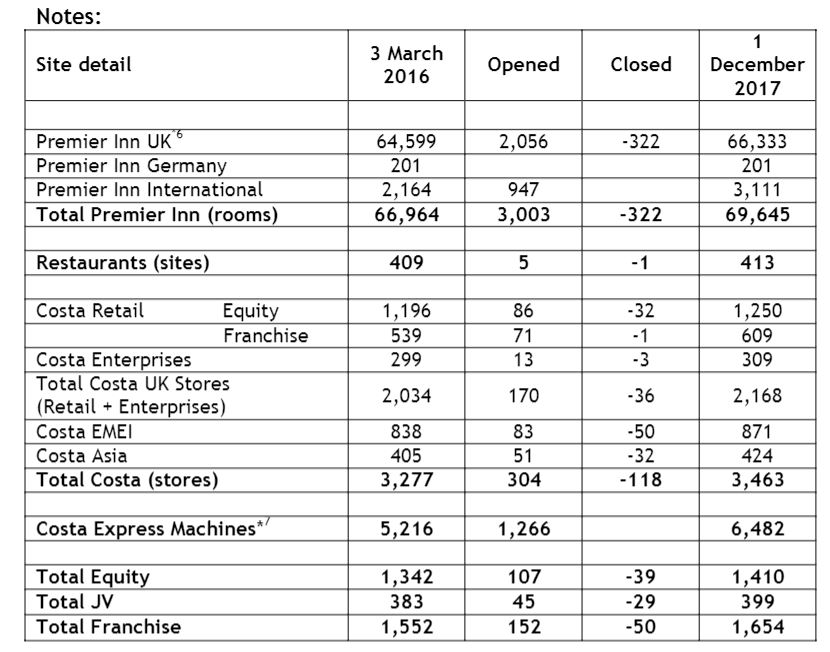

“We continue to make good progress against our three point strategic plan: to grow and innovate in our core UK businesses; to focus on our strengths to grow internationally; and to build the capability and platform to support future growth. We remain on track to open c.3,700 new UK Premier Inn rooms and our committed pipeline stands at around 14,000 UK hotel rooms. We have also recently signed two additional sites in Germany (Freiburg and Essen) taking our committed German pipeline to five hotels. We expect to open 230-250 net new Costa coffee shops worldwide and to install at least 1,500 new Costa Express machines, having already surpassed our previous guidance of 1,250 in the current financial year.

In the quarter our brands continued to win market share growing total sales by 8.6% and like for like sales by 1.7%. Trading since the end of the quarter is such that we expect to deliver full year results in line with expectations.

Premier Inn grew total sales in the quarter by 9.2%. We have opened 15 hotels in the UK since the start of the year, increasing the number of rooms available by 9.7%, whilst maintaining occupancy at a high level of 84.5%. Like for like sales grew by 1.8% benefitting from our hotel extension programme which, as expected, diluted our like for like revpar, which was down 1.3%.

In the quarter, Costa delivered total sales growth of 12.5% and good like for like sales growth of 4.3%. This performance was supported by its new advertising and promotional campaigns and benefitted from the timing of the quarter end, which included a strong start to the Christmas period. For the comparable period, to 26 November, excluding this timing benefit, Costa’s like for like sales growth was 2.9% *3.

Our property strategy is to carry out a modest number of sale and lease back transactions in order to recycle capital into strong returning new growth opportunities and we successfully completed two such transactions in December.

We now expect total sale proceeds for the year to be in the region of £200 million. These transactions highlight the strong asset backing to our balance sheet and are evidence of how we optimise our significant property portfolio.

- Premier Inn has grown total sales for the 39 weeks by 9.0%, by continuing to win UK market share, growing like for like sales by 2.2% and total room nights sold by 8.5% to 14.7 million. As anticipated total revpar was down 0.7%, compared to the total market growth of 0.9%, due to the impact of our hotel extensions programme. Total occupancy remained high at 83.2%, whilst the number of rooms available increased by 9.5%. In the quarter, revpar for the total market was down 0.3%, with the non-budget sector supported by a weaker sterling and higher inbound tourism to London.

- Restaurants delivered total sales growth for the 39 weeks of 0.5% with like for like sales down 0.2%, slightly ahead of a soft pub restaurant market outside the M25.

- Costa had another good sales performance, growing total system sales for the 39 weeks by 13.0% to£1,317 million (10.4% at constant currency). Within this, franchise system sales grew by 13.6% to £503 million (9.1% at constant currency). Costa UK Retail grew system sales by 11.6% to £708 million.

- Costa Enterprises grew system sales for the 39 weeks by 9.3% to £322 million respectively, while International system sales increased by 21.4% to £287 million (9.2% at constant currency). We remain committed to the long-term growth opportunities for Costa in China, despite a tougher near-term trading environment.

- Year to date we opened 186 net new stores worldwide and installed 1,266 Costa Express machines. This exceeds our target for 1,250 installations this year and takes the total number of Costa Express machines to 6,482, of which 696 are in international markets. We now expect to install at least 1,500 new Costa Express machines this financial year.

Conference call for analysts and investors

Alison Brittain and Nicholas Cadbury will be available for a conference call at 08.00am today. To participate, dial 0800 6945707 and enter Conference ID: 51525826 or international participants dial +44 (0)1452 541003.

A recording of the conference call will be available until the 9th February 2017. To listen, dial 0871 7000145 and enter the passcode 51525826. International +44 (0) 1452 550000. This service will be active approximately two hours after the conference call has finished. Please dial into the call 10 minutes before to ensure you don’t miss the start.

For more information please contact:

Investor Relations

Nicholas Cadbury, Whitbread PLC +44 (0) 20 7806 5491

Joanne Russell, Whitbread PLC +44 (0) 1582 888633

Press Contacts

Anna Glover, Whitbread PLC +44 (0) 7768 917 651

David Allchurch, Tulchan +44 (0) 20 7353 4200

For photographs and video please visit our media library on

www.whitbreadimages.co.uk

Notes to Editors

Whitbread PLC is the owner of the UK’s favourite hotel chain, Premier Inn and the UK’s favourite coffee shop, Costa, as well as restaurant brands, Beefeater, Brewers Fayre and Table Table. Whitbread PLC employs 50,000 people in over 2,300* outlets across the UK, with its well-loved brands making every day experiences special for over 27 million UK customers every month.

Whitbread has outlined growth milestones for 2018 and 2020. The 2020 milestones are to increase the number of Premier Inn UK rooms to around 85,000 and to achieve global system sales of around £2.5bn for Costa. At Whitbread we are committed to being a force for good in the communities in which we operate. Our CR programme, ‘Good Together’ is focused on three pillars of Team & Communities, Customer Wellbeing and Energy & Environment.

In the year ended 3 March 2016, Whitbread PLC reported a 12.0% increase in Group Revenue to £2,921.8 million and Underlying Profit before tax of £546.3 million up 11.9%. Whitbread PLC is listed on the London Stock Exchange and is a constituent of the FTSE 100. It is also a member of the FTSE4Good Index.

*excludes Costa Franchise stores and Costa Express