Corporate debt

We currently have in place the following committed revolving credit facilities:

| Amount | Description | Maturity date |

|---|---|---|

| £775m | Revolving Credit Facility | May 2029 |

An amount of £35m has been carved-out from the limit for an ancillary facility.

Bonds

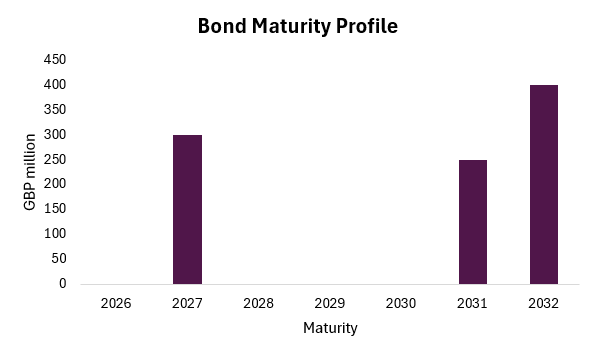

Long 6 Year £300m 2.375% Guaranteed Green Notes due 31 May 2027

Long 10 Year £250m 3.00% Guaranteed Green Notes due 31 May 2031

Long 7 Year £400m 5.50% Guaranteed Notes due 31 May 2032

As at 16 October 2025, the weighted average maturity of the group’s debt was 4.8 years.

Green Bond

On 10 February 2021, Whitbread Group plc issued £300m 2.375% guaranteed green notes due May 2027 and £250m 3.000% guaranteed green notes due May 2031.

The relevant documents are available to view below:

Documents incorporated by reference

Green documents

£400m 5.50% Guaranteed Notes Due 2032

On 12 February 2025, Whitbread Group plc issued £400m 5.50% guaranteed notes due May 2032.

The relevant documents are available to view below:

Credit rating

| Ratings agency | Date | Short term | Long term |

|---|---|---|---|

| Fitch | 23 May 2025 | F2 | BBB (outlook negative) |